Brad Garlinghouse stressed Ripple’s unchanged commitment to transparency but hinted that future reports might undergo some changes.

NEWS

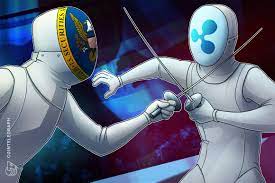

Ripple CEO Brad Garlinhouse on Aug. 2 expressed his disapproval of the United States Securities and Exchange Commission for utilizing Ripple’s quarterly XRP

Markets Report, designed to enhance transparency in the cryptocurrency industry, as evidence against the company in the ongoing lawsuit.

Garlinghouse stated that the company initiated the reports with the intention of voluntarily offering updates on its XRP holdings. However, the CEO said these reports were later “used against” the company in the SEC’s lawsuit. Garlinghouse reiterated the company’s commitment to transparency but hinted that future reports might undergo some changes.

As per the official announcement on July 31, Ripple, the crypto payments solutions firm, unveiled its Q2 2023 XRP Markets Report. This report stands out from previous quarters, as it centers on key highlights, such as Judge Torres’ significant summary judgment ruling, clarifying misconceptions and shedding light on Ripple’s XRP holdings.

The report reveals that Ripple’s XRP holdings surged from 5,506,585,918 to 5,551,119,094, representing an increase of approximately 45 million. Simultaneously, the total XRP on ledger escrow decreased by nearly 1 billion, which can be attributed to the rising demand for XRP.

In addition to Ripple CEO’s criticism, XRP lawyer John Deaton also expressed strong disapproval of the SEC’s use of these reports as evidence against the company and its executives in the ongoing lawsuit. He said that Ripple willingly publishes these reports on a quarterly basis, while other firms not only conceal token sales but also deliberately disguise such transactions.

Ripple acknowledged the significant ruling made by Judge Torres in the case of Securities and Exchange Commission v. Ripple Labs on July 13, which declared that XRP is not considered a security. However, the company clarified that, while all XRP sales are not classified as securities, sales executed under written contracts can be categorized as investment contracts and thus fall under the security classification.

Related: Judge rejects motion to dismiss Terraform case, disagrees with Ripple decision

Furthermore, Ripple addressed misconceptions surrounding its partial victory, stressing that while XRP is not a security in certain contexts, it may still be considered as such in specific circumstances. Additionally, the company clarified that the ruling provides protection to sophisticated institutions but does not extend the same protection to retail buyers.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.